306 429,6 mw de capacité photovoltaïque cumulée dans l’Union européenne fin 2024

Le solaire photovoltaïque a une fois encore démontré sa capacité à se déployer de manière extrêmement rapide à l’échelle mondiale. Selon l’Irena, l’Agence internationale pour les énergies renouvelables, la puissance maximale nette solaire photovoltaïque mondiale s’est établie à 1 858,6 GW fin 2024, soit 451,9 GW de plus qu’en 2023. Cette puissance additionnelle est en augmentation de 28,1 % par rapport à 2023, année où 352,7 GW avaient été ajoutés. La Chine demeure, et de loin, la principale zone d’installation (+ 278 GW), représentant plus de 60 % du marché mondial. L’Union européenne est restée en 2024 le second marché mondial avec, selon EurObserv’ER, une puissance maximale nette additionnelle de l’ordre de 60 GW, devançant franchement les États-Unis et l’Inde. Cette croissance solaire mondiale s’accompagne désormais d’un développement à grande échelle du stockage électrochimique avec déjà plusieurs dizaines de GW installés en Chine et aux États-Unis et des marchés européen et indien en plein essor.

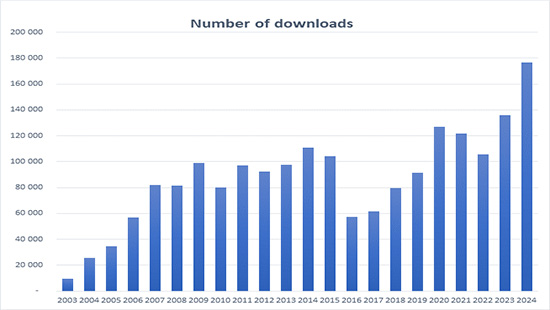

Télécharger en Français

Download in other languages : ![]()