– 0.6 % The decrease of inland consumption from solid biofuels in the EU27 between 2023 and 2024

– 0.6 % The decrease of inland consumption from solid biofuels in the EU27 between 2023 and 2024

The European Union’s primary solid biomass energy consumption fell again in 2024, by 0.6% compared with 2023, though the decline was smaller than in the previous two years. According to EurObserv’ER, consumption stood at 94.8 Mtoe in 2024, compared with just under 95.4 Mtoe in 2023 (revised figure), far below the levels seen in 2021 (104.8 Mtoe) and 2022 (100.2 Mtoe). This trend reflects a return to a new equilibrium following the major disruptions experienced in the energy market due to rising gas prices and the tensions caused by the Russia-Ukraine war. In terms of final energy, European solid biomass electricity production decreased by only 0.9% between 2023 and 2024, reaching 78.1 TWh, while heat consumption — whether delivered through a network or used directly by end users — fell by just 1.0% over the same period, reaching 77.3 Mtoe.

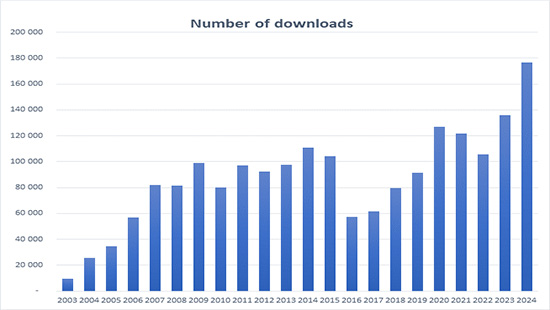

Download

Download in other languages : ![]()